(29 Aug 1997) English/Nat

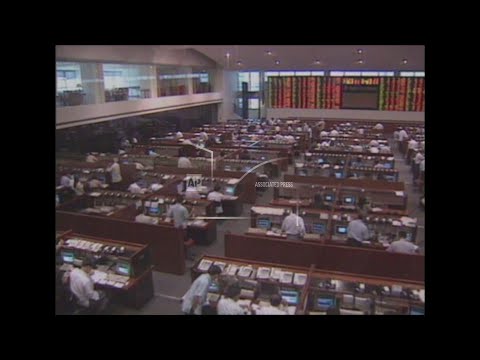

The Philippine stock market fell for a sixth day on Friday, with the main index plunging as much as 8.4 percent before bargain hunters trimmed its losses late in the session.

The 30-share Philippine Stock Exchange Index ended down 50.45 points, or 2.4 percent, at 2,021.52, according to preliminary figures.

It was the second day of record lows for the Philippine Stock exchange on Friday.

On Thursday it fell 212.06 points, or 9.3 percent – its biggest one-day drop.

The index now has lost 437.52 points, or 18 percent, since August 22, and 1,426.08 points, or 41 percent, from its all-time high of 3,447.60 on February 3.

At one point on Friday, the index had fallen more than 173 points to about 1,898 before the bargain hunters stepped in.

Traders say the main concern is currency stability.

The Philippine peso has fallen along with other currencies in the region, generally because of speculation.

Traders said the early selloff was triggered by a central bank move to reduce the amount of money available for currency speculation and by the release of first-half economic data which showed a slowdown in economic growth from the same period last year.

SOUNDBITE: (English)

"The market went down again by another 50 points after going down yesterday a record low of more than nine percent. We expect the market to correct next week probably, but not back to the levels we were last week. The sentiments are pretty negative right now because of the (Central Bank’s) move to contain liquidity to make the peso more

attractive against the dollar by increasing liquidity reserves to eight per cent from five percent. This is a contractionary policy which would lead to higher interest rates and probably in order to stem the speculation on the peso. However this move would mean that corporate earnings and economic growth would be hampered on the second half of this year so prospects for the rest of the year are not as good as projected, so we expect the market to be rather negative for the rest of the year."

SUPER CAPTION: Jose Vistan, stock analyst

The peso has fallen nearly 15 percent against the U-S dollar since July 11, when monetary authorities allowed it to move in a wider range in response to heavy speculative attacks following Thailand’s decision to float its currency, the baht, on July 2.

Find out more about AP Archive: http://www.aparchive.com/HowWeWork

Twitter: https://twitter.com/AP_Archive

Facebook: https://www.facebook.com/APArchives

Instagram: https://www.instagram.com/APNews/

You can license this story through AP Archive: http://www.aparchive.com/metadata/youtube/ac8039f1ae81300d8a1b091e48a659a0

Author: AP Archive

Go to Source

News post in March 2, 2025, 3:04 pm.

Visit Our Sponsor’s:

News Post In – News