(7 Nov 2024)

RESTRICTION SUMMARY:

ASSOCIATED PRESS

Hong Kong – 7 November 2024

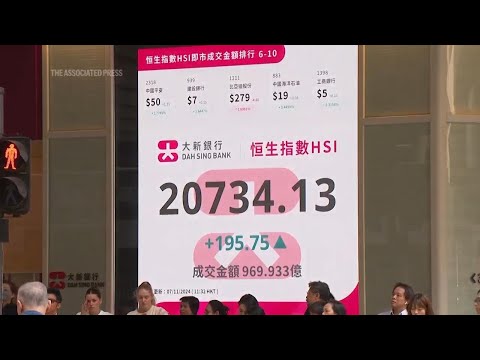

1. Various of Hong Kong Exchange building with flags and electronic display showing benchmark Hang Seng Index

2. SOUNDBITE (English) Francis Lun, CEO, Geo Securities:

++SOUNDBITE STARTS ON PREVIOUS SHOT AND IS OVERLAID BY SHOT3++

"Donald Trump might not be the president that the Chinese government wants to see, but we know what to expect and we know that tariffs will increase and there will be some problems on Chinese exports. But then, I think domestic issues are more important now. People want the government to spend some money to boost the economy, instead of looking outward."

3. Various of people on street with electronic display showing benchmark Hang Seng Index

ASSOCIATED PRESS

Tokyo, Japan – 07 November 2024

8. Interior of the Tokyo Exchange

4. Various of display board of JPX

5. Nikkei index display

ASSOCIATED PRESS

Taipei – 7 November 2024

6. Close of TWSE sign at the entrance

7. Various of index running on tickers

STORYLINE:

Shares recovered from early losses in Asia on Thursday after U.S. stocks stormed to records as investors wagered on what Donald Trump’s return to the White House will mean for the economy and the world.

Markets also were turning their attention to the Federal Reserve’s decision on interest rates, due later in the day.

Hong Kong’s stock market has survived Donald Trump winning the US presidential election without a major shock.

The benchmark Hang Seng Index fell at start of trading Thursday, the day after the vote, but recovered and started to climb back.

The Hang Seng Index was up just over 1 percent by lunchtime Thursday, not a big move by Hong Kong trading standards, but still a sign of stability in investor sentiment.

Japan’s Nikkei 225 was down 0.1% at 39,458.86, while the Kospi in Seoul rebounded to pick up 0.5%, to 2,576.30.

Taiwan’s stock market opened slightly lower on Thursday and then rose more than 200 points.

Trump has promised to slap blanket 60% tariffs on all Chinese imports, raising them still more if Beijing makes a move to invade the self-governing island of Taiwan.

Investors are adding to bets built earlier on what the higher tariffs, lower tax rates and lighter regulation that Trump favors will mean. Higher tariffs on imports from China would add to the burdens Beijing is facing as it struggles to revive slowing growth in the world’s second-largest economy.

Higher tariffs on imports from China, Mexico and other countries also would raise the risk of trade wars and other disruptions to the global economy.

But Trump’s win raised expectations that Beijing may ramp up its spending and other stimulus to counter such trends. The Standing Committee of China’s legislature is meeting this week and is expected to announce further measures by Friday.

===========================================================

Clients are reminded to adhere to all listed restrictions and to check the terms of their licence agreements. For further assistance, please contact the AP Archive on: Tel +44(0)2074827482 Email: info@aparchive.com.

Find out more about AP Archive: http://www.aparchive.com/HowWeWork

Twitter: https://twitter.com/AP_Archive

Facebook: https://www.facebook.com/APArchives

Instagram: https://www.instagram.com/APNews/

You can license this story through AP Archive: http://www.aparchive.com/metadata/youtube/d619d6c167164c179b3ecbdf6d625f5b

Author: AP Archive

Go to Source

News post in November 12, 2024, 9:00 am.

Visit Our Sponsor’s:

News Post In – News